London- and Toronto-listed Endeavour Mining sold its Boungou and Wahgnion mines, in Burkina Faso, for $300-million, as part of its strategy to focus on higher quality assets. The mines, deemed noncore to Endeavour, were sold to Lilium Capital, an African and frontier markets-focused investment vehicle led by West African entrepreneurs. The total consideration comprises of upfront and deferred cash considerations, as well as net smelter return royalties.

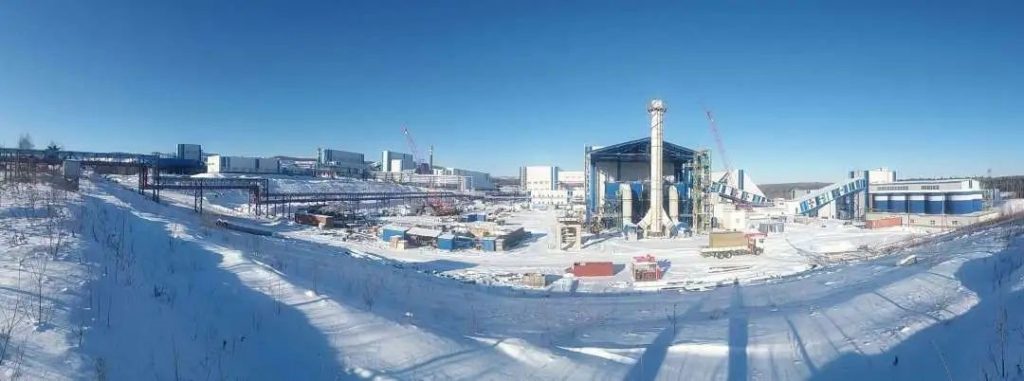

Endeavour has reduced its 2023 guidance from between 1.32-million and 1.42-million ounces, to between 1.06-million and 1.13-million ounces at an all-in sustaining cost (AISC) of $895/oz to $950/oz. Boungou mine is expected to produce 115 000 oz to 125 000 oz at an AISC of $985/oz to $1 075/oz, and the Wahgnion mine between 150 000 oz and 165 000 oz at an AISC of $1 250/oz to $1 350/oz. The asset sale will be offset by Endeavour’s ongoing construction activities as the group’s production and AISC will significantly improve next year when the Sabodala-Massawa brownfield expansion in Senegal and the Lafigue greenfield project, in Cote d’Ivoire, are commissioned.

Endeavour acquired the Boungou mine when it bought Semafo in 2020, while it brought Wahgnion into its fold as part of the acquisition of Teranga in the following year. “We believe that Lilium Mining is well positioned to continue to unlock value at the Boungou and Wahgnion mines, for the benefit of all stakeholders. Moreover, Lilium is a trusted Burkinabe-focused business that shares our commitment to operate the mines in the best interests of employees and local stakeholders,” said president and CEO Sebastien de Montessus.